Tax Bracket Explanation: An Important Topic in Estate Planning

This is a simple breakdown of the amount someone pays on their federal income taxes. Math isn't everyone's strong suit, but income and profit need to be understood at a basic level.

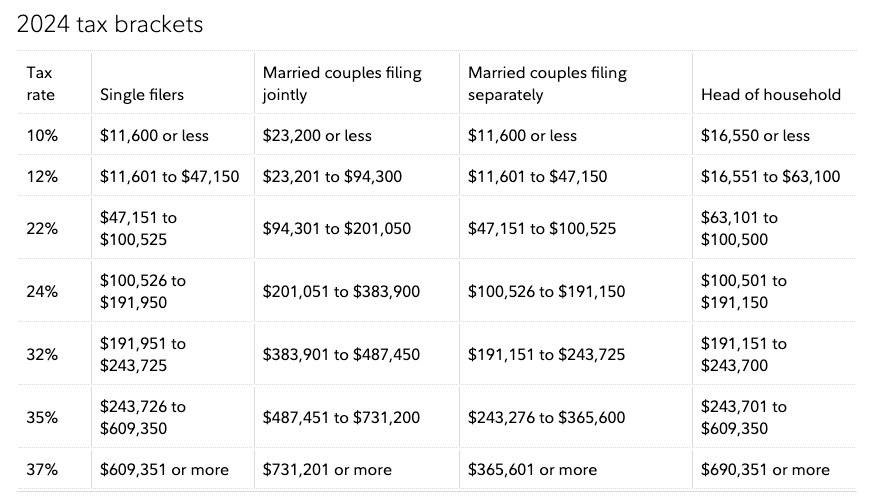

For starter, when most hear the term "tax bracket," they immediate thing of percentage of taxes they will owe the IRS at the end of the year. Numbers or percentages like the following fill the imagination:

- 10%

- 12%

- 22%

- 24%

- 32%

- 35%

- 37%

If someone earns $100k a year, they fear the 22% tax bracket because that is $22k of $100k. However, simply put, the tax bracket operates is steps or phases. For example, in 2024, a Married Couple that has a household income of $100k, would see the following tax brackets:

- The first $23,200 would be taxed at 10% (i.e. $2,320)

- The next $71,100 of income up to $94300 would be taxed at 12% (i.e. $8,532)

- The next $5,700 (to make $100k) of income up to $201,050 would be taxed at 22% (i.e. $1254)

So, the overall federal income tax would be $12, 106 versus the general belief of $22k at 22%.

Another example may be helpful, but this time a married couple that that has a household income in 2024 at $250k. The bracket breakdown would be as follows:

- The first $23,200 would be taxed at 10% (i.e. $2,320)

- The next $71,100 of income up to $94,300 would be taxed at 12% (i.e. $8,532)

- The next $106,750 of income up to $201,050 would be taxed at 22% (i.e. $23,485)

- The next $48,950 (to make $250k) of income up to $383,900 would be taxed at 24% (i.e. $11,748)

So, the overall federal income tax would be $46,085 versus the general belief of $60k at 24%.

A visual may help understand the bracket layout:

Now, this discussion is only focusing on Federal Income Tax, a further evaluation would need to be conducted to determine the State Income Tax and the method in which the income is received (i.e. as a W2 Employee, a Independent Contractor, an LLC, a C Corp, an S Corp, etc.).

Disclaimer: This Blog is made available by the lawyer or law firm publisher for educational purposes only as well as to give you general information and a general understanding of the law, not to provide specific legal advice. By using this blog site you understand that there is no attorney-client relationship between you and the Blog/Web Site publisher. The Blog should not be used as a substitute for competent legal advice from a licensed professional attorney in your state.