By Franchesco Fickey Martinez

•

May 14, 2025

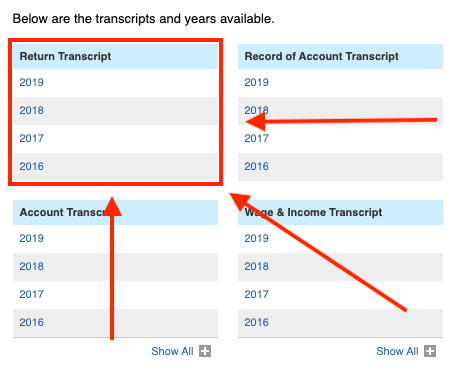

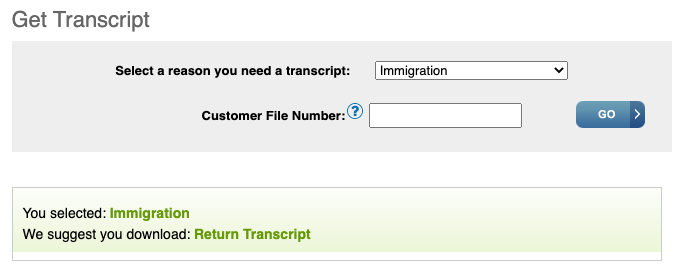

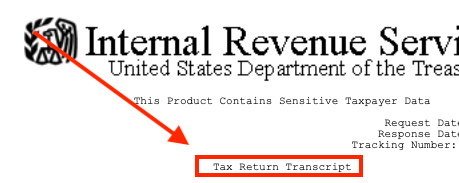

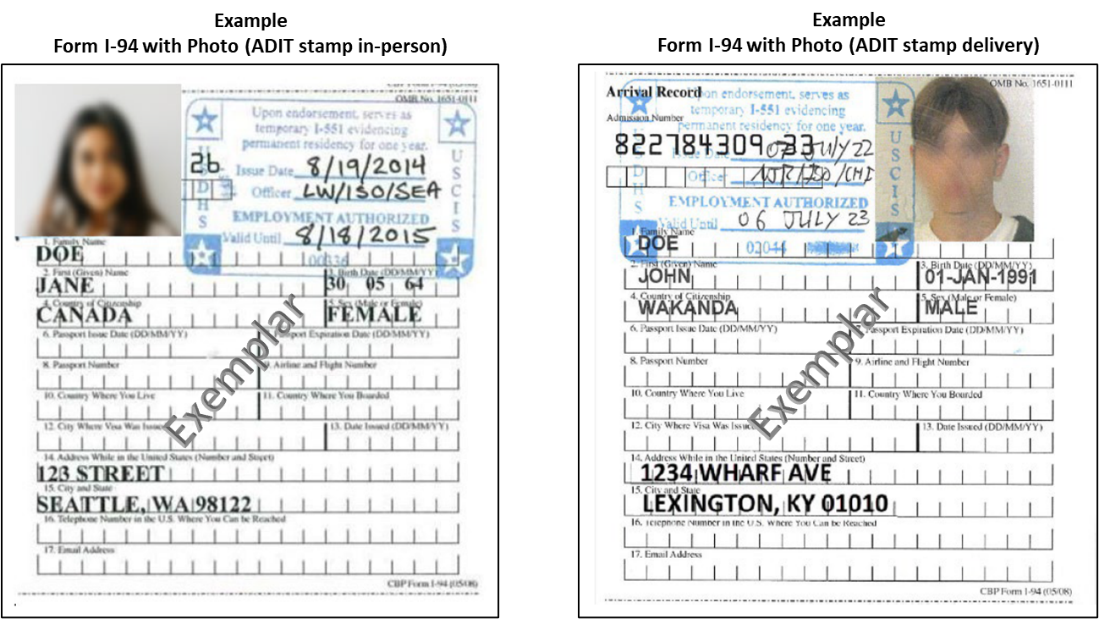

This article will cover the Old Versions of the Green Cards and how they encounter issues with the DMV when attempting to renew a Driver's License as well as with SSA when attempting to acquire Medicaid, SSD, or SSI. The I-151 Green Card: The former Immigration and Naturalization Service (INS) issued Form I-151 (Alien Registration Receipt Card), commonly called a “green card,” to aliens from: July 1946 to 1978. The I-151 Green Card never had an expiration date printed on the card, which has led many to believe their documentation was up-to-date. Even in 2025, I-151 Green Card holders never knew their Green Card had actually expired by law on March 20, 1996 . I-151 card holders experience issues with the DMV, especially after the Real ID Requirements of May 2025, due to the INS records not being easily accessible in current government system, as the INS agency ended in 2003 and was replaced by the agency: USCIS. Additionally, due to I-151 Card Holder's ages, they have either been receiving SSI and Medicaid for many years, or will be starting very soon. For example, if an I-151 Green Card holder received their I-151 Card in 1970 at the age of 10, they would be turning 65 in 2025. According to SSA: Form I-151 is not a valid immigration document. The card lacks security features and presents more opportunities for alteration and fraud than the immigration documents currently being issued. From 1992 through 1996, the former Immigration and Naturalization Service conducted a “Green Card Replacement” project to replace the I-151 cards in circulation. Although the card is not a valid immigration document, the person may still retain lawful permanent status. (Source: https://secure.ssa.gov/poms.nsf/lnx/0200303400) I-151 Card Holders are recommended, depending on their given situation, to either apply for an I-90 Green Card renewal or apply for US Citizenship with the N-400. The I-551 Green Card that didn't expire: The I-551 Green Card is the "current version" of the Lawful Permanent Resident Card. However, there is a lot of confusion on whether the cards with “no expiration date” are still valid. Some government agencies may refer to this un-expiring I-551 as the: ORIGINAL I-551 Whereas, the expiring I-551 may be reviewed to as the: REVISED I-551 The I-551 Green Cards issued between: 1977 and August 1989 have no expiration date, but ARE STILL a valid and acceptable Green Card. However, not every US Agency will acknowledge the old version of the I-551 Green Card since it lacks an expiration date, and a way for the agency to confirm current legal immigration status from when the card was issued in 1977 to 1989. For the DMV, the unexpiring I-551 Green Card may or may not be accepted. A lot has to deal with name changes over the years and whether the file is accessible in current government systems. For SSA, the old or original I-551 is generally accepted as identity is normally compared against a lifelong history of SSA Contributions in Prior Payroll and tax filings. Original I-551 Card Holders are recommended, depending on their given situation, to either apply for an I-90 Green Card renewal or apply for US Citizenship with the N-400 as to avoid issues that may arise in the next few decades (unknown how laws might change). What do I do if I need a new I-551 Green Card ASAP? By filing for either I-90 or N-400, USCIS may issue a "temporary I-551 proof" that can be in the form of the passport, a sticker on the card, or a stamp in an I-94 Card. This temporary proof is called an ADIT Stamp and can be acquired at a local USCIS Office in an INFOPASS Appointment. (More information can be seen here: https://www.fickeymartinezlaw.com/need-a-temporary-green-card-information-on-the-adit-stamp) The following is the SSA policy on ADIT Stamps: When the alien does not have a machine readable immigrant visa (see RM 10211.025C.2 ), DHS places a temporary I-551 stamp in the foreign passport as evidence of immigration status when the alien is admitted to the U.S. as an LAPR for the alien to use until the permanent I-551, Permanent Resident Card, is received. The stamp may be placed in the alien’s foreign passport or on a Form I-94, Arrival/Departure record, when the alien does not have a passport. When an alien previously admitted to the U.S. applies for a replacement I-551 or adjusts to LAPR status, DHS places a temporary I-551 stamp in the foreign passport. When the alien does not have a foreign passport, DHS places the temporary I-551 stamp, a photo of the alien, and DHS seal on Form I-94. Each stamp is uniquely numbered with a five-digit identifier which can be found below the “Valid Until” line. Also, the officer writes the “A” number on the stamp. See the ACM Alert No. 2006A-31 New DHS/USCIS ADIT Stamp under the “I-94” document number and “I-551” document number for more information on the design and fluorescent security features. (Source: https://secure.ssa.gov/poms.nsf/lnx/0200303440#b1)