Estate Planning for Children and Grandchildren: One Deposit at Birth could likely make them a Millionaire by 65

Time is always the biggest factor when considering investment and return on capital. Similarly, timing is always the biggest factor of estate planning. This Article will cover the often overlooked importance of estate planning: starting as early as possible. Specifically, we will cover the hypothetical of investing into a retirement account a mere $7000 when a child or grandchild is born.

There are two popular/possible “retirement accounts” a parent or grandparent can invest into at or around birth:

- A 529 Plan

- Custodial IRA

What is a 529 Plan?

A 529 Plan is a tax-advantaged savings plan that helps parents and grandparents save for education expenses. The primary purpose of a 529 Plan is for a parent or grandparent to save for a child's schooling or college. However, oversaving is a common concern. To help alleviate the concern, a Roth IRA Rollover option was created in 2022.

The Limitations are as follows:

- Lifetime limit for rollovers is $35,000, which is about 5 years of contributions, based off of 2024's annual limit of $7000.

- The 529 plan must have been open for at least 15 years.

- Contributions made to the 529 plan in the last five years cannot be transferred.

- If the beneficiary child or grandchild contributes to an IRA in a given year (if working during college and contributing to the IRA at the same time), the rollover amount is reduced by that amount.

- The rollover must be direct, such as plan-to-plan or trustee-to-trustee.

What is a Custodial IRA?

A custodial IRA is a Roth/Post-Tax retirement account that an adult sets up and manages for a minor. The Child "Owns" the account, and the account can ONLY be funded with the Child's Earned Income. The custodian, usually a parent or grandparent, would be able to manage the account until the child turns 18 or 21, depending on the state's laws of when such accounts must be transferred to the child free and clear of the parent or grandparent. The catch of this IRA Option is the requirement that the Contributions are technically coming from the paychecks of the minor.

Wait, you said to invest at BIRTH, but then mention saving for college or a child/grandchild working a job!

Unfortunately, there is not one magical account that is built for a newborn to become a millionaire 60 years later, but with the types of accounts that are currently available, the "Likely Vehicle" that would enjoy tax advantages over the decades would be, at the end of the day, a Roth IRA.

Both, a 529 Plan and Custodial IRA could lead to a Roth IRA eventually.

What if I just invested in stocks and gifted them to the minor when they turn 18?

This is a common scenario where a parent or grandparent was fairly savvy with the stock market and could turn $7000 into $50,000 by the time the child turns 18. Maybe a grandparent invested in Apple stock or Microsoft stock a few years ago. This scenario also keeps the "ownership" of the investment in the name of the parent or grandparent.

However, the largest disadvantages of this scenario would be the:

- tax consequences, and

- the gift limitations.

If you invested $7000 years ago, and now the stock value is $50,000, taxes would have to be paid on the $43,000 for the long-term capital gains. What if the tax bill was $10,000 or $15,000, that $50,000 investment would shrink by 20% due to the tax liabilities.

When investing in a retirement account that has a potential of leading to a Roth IRA, the investments growth would avoid taxation.

To the Question/Topic: One Deposit at Birth could likely make them a Millionaire by 65

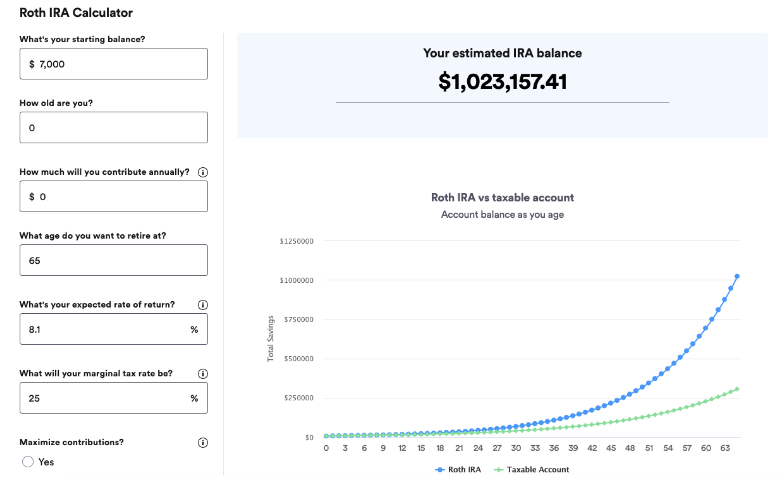

If $7,000 was funded at one time at birth, the investment had a return of 8.1% every year for 65 years. After 65 years, the $7,000 may grow to an estimated Balance of $1,023,157.41. That is a nice sum of money to leave behind to a family member, especially if that money is in a tax-advantaged account, meaning no tax would be taken from it for the rest of the child or grandchild's life.

Below is a table to illustrate 65 years of growth under this topic:

How do you get started?

First, Contact an estate attorney to review your assets, liabilities, and overall retirement plan. The estate attorney can explain the process, assist with creating a trust or will, and explain asset transferring and your ultimate goals. An estate attorney can also have useful ideas, like starting one or multiple $7000 investments for children or grandchildren..

Second, time matters, and starting as soon as you can is important.

Disclaimer: This Blog is made available by the lawyer or law firm publisher for educational purposes only as well as to give you general information and a general understanding of the law, not to provide specific legal advice. By using this blog site you understand that there is no attorney-client relationship between you and the Blog/Web Site publisher. The Blog should not be used as a substitute for competent legal advice from a licensed professional attorney in your state.