By Franchesco Fickey Martinez

•

06 Feb, 2024

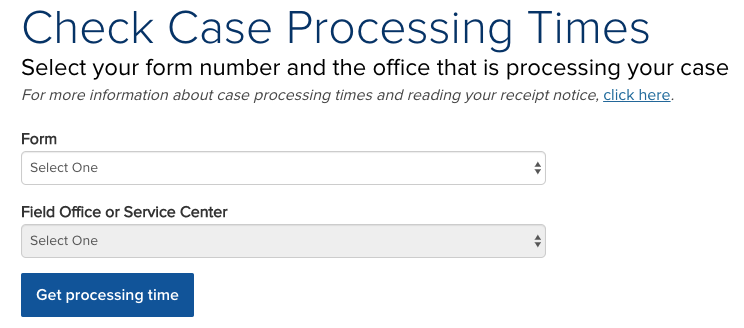

A rental usually takes one of three forms. First, it may be a prior home that you lived at, and due to moving, or change of circumstance, or due to opportunity, you moved to another home, but you decided not to sell your first property due to rising property values, sinking property values, possibly a good interest rate on the loan, sentimental attachment to the property, or maybe there was a possibility that one day you would return to that home. Second, you are an individual that views properties as, a form of investment. Third, you are a business, which is similar to an individual, and might be what the individual investor becomes once they collect 2 or 3 or 4 or 10 or 20 rental properties. All of these forms hold the rental property as an income producer. A rental property can be a retirement plan, it can be an investment, it can generate cash flow; however, as most landlords know, a rental can also be a liability. Why set up a trust to manage one or multiple rental properties? Safety. If you have ever had the pleasure of being sued by a tenant, maybe it was a counter lawsuit from an eviction, maybe it was from damage to the rental property that the tenant performed, maybe it stemmed from an accident by a third-party. The owner of a property, the landlord, is able to be sued. Lawsuits carry financial risk. Risks SHOULD be reduced and mitigated wherever possible. A trust is essentially the creation of a new legal entity, "a paper clone" of the landlord. The trust would receive its own FEIN number (a ss# equivalent), the trust would be listed as the owner and some fashion, and the trust can determine what liabilities of the landlord Should be left open to. A trust is a tool that helps create safety. Who can set up a trust for rental property purposes? It is recommended to have an estate attorney set up the trust, the ancillary businesses, possibly be the trustee, and hire a property management firm. This description alone summarizes essentially the creation of three or four invisible barriers between the landlord and the tenant/rental property. The rental property should be free and clear of any loans, as loan providers would not generally permit trusts. Loan providers want to hold the landlord personally liable for the debt on the property, and they would not agree to a trust and its invisible barriers. However, if a landlord owns 100% of the equity, the landlord can deed the property to their trust clone for zero dollars. Although there are templates and packages that can be purchased online, the old adage comes to mind: you get what you pay for. What about a virtual lawyer that was found online? That could be compared to a magic trick, whenever a problem arises: Now you see me, now you don’t. Although, invisibility might be a superpower rather than a magic trick. Again, you get what you pay for. If you pay for a local attorney that has a brick and mortar location, very unlikely that they brick and mortar can disappear when a problem arises. The local attorney would charge more than the few-buck template online or the super cheap virtual lawyer, but they are less likely to be a risk or liability, and more likely to be considerably helpful and a barrier to help promote the landlord financial safety So, how does a trust remove the landlord from the equation? Simple, the landlord is the person or entity on the deed. The trust name would appear on the deed versus the landlord name. The trust name should not match the landlords name, such as John Smith named their trust John Smith Realty Trust, as to help differentiate property ownership. Also, if there was a lawsuit, the landlord personally May Not be able to be named, if a few other things occur. For instance: The rental property has a property management company that is the face and rent collector of the operation A business owns the rental property and that business is owned by the trust An estate attorney is acting as the trustee, being the signature on behalf of the trust If I am no longer the landlord, and my trust clone becomes the owner, what happens to the income and profit? The beauty of a trust is that it is a clone of the landlord, and it follows the guidelines or instructions that it was given when it was created. Put another way, the trust will act like a robot, and will do what it’s creator decided. For instance, a simple set up would be the trust was created to own the property and receive the remainder of any rent checks after the property managers fee. 50% of the profit can be paid to the original landlord once a month as a direct deposit to a personal bank account. The remaining 50% is to be automatically placed into a high yield savings account under the trust. From that account, the trust can withdraw from it once a year to pay property taxes and income taxes. The remainder is to stay in the high yield savings account to pay for any unexpected repairs on the rental property. A more complex set up could introduce CDs, stock ownership/investment, purchasing a certain amount of gold and silver, even purchase more land or rental properties either by cash or by loan. As an investment, the complexities can grow to, as much as can be imagined. The catch, once the robot is created, the instructions of what to do are given, the original landlord may not, or should not be able to alter the set up, as to avoid future risks and the liabilities. After all, the goal is safety. Is a trust able to help the landlord with their taxes? Possibly, it depends on how much money is placed in the landlord’s bank account, as that would be calculated as income attributed to the landlord. In and above example, 50% of the income remains in the trust bank account, and 50% distributed to the landlord, the 50% distributed to the landlord would be counted as the landlord income, and 50% that remain with the trust, would be included in the trust tax return. Even clones need to pay their taxes, but there is a major benefit, the bracket of the clone would likely be much lower than the tax bracket of the human landlord. The trust is able to provide security, but also allow the landlord, through a trust, to maintain or build wealth. Disclaimer: This Blog is made available by the lawyer or law firm publisher for educational purposes only as well as to give you general information and a general understanding of the law, not to provide specific legal advice. By using this blog site you understand that there is no attorney-client relationship between you and the Blog/Web Site publisher. The Blog should not be used as a substitute for competent legal advice from a licensed professional attorney in your state.